Your Home. Your Loan. Your Way.

Understanding the Mortgage Options at Northpoint Mortgage Every homebuyer’s journey looks different – and the loan you choose should be just as unique as your goals, budget, and long-term plans. At Northpoint Mortgage, we offer a full suite of mortgage products designed to meet borrowers where they are and help them move confidently toward homeownership. […]

How Much House Can I Afford in Georgia?

A Simple Guide from Northpoint Mortgage Buying a home is one of the biggest milestones in life — and one of the most common questions Georgia homebuyers ask is: “How much house can I actually afford?” The answer depends on several factors unique to you — not a one-size-fits-all formula. At Northpoint Mortgage, our goal […]

Homebuying in Fulton County: Your Top Questions Answered

Buying a home can feel like a maze — but here’s the good news: you may already qualify for a mortgage and not even know it. At Northpoint Mortgage, we’ve helped thousands of Georgia families open the door to homeownership by guiding them through every twist, turn, and “what if” moment along the way. With […]

Fed Pauses Recent Hikes, Good News For Mortgage Rates

Fed Pauses Recent Hikes, Good News For Mortgage Rates The Federal Reserve decided to keep interest rates steady at its June meeting this week. This was the first time since March 2022 that the Fed has not raised rates. The move bodes well for the housing market and home buyers in search of rate stability or […]

Navigating 2024 Housing – What Homebuyers Can Expect

Navigating 2024 Housing – What Homebuyers Can Expect The past year defied many expectations in the housing market, with significant shifts that caught many by surprise. As we look ahead to 2024, understanding these trends is crucial for anyone considering buying a home. Here’s a breakdown of what happened in 2023 and what experts predict […]

Market Update: FOMC Meeting Summary for March 20th

As part of our commitment to keep you informed, we’re providing a snapshot of the latest FOMC meeting and its implications for the mortgage market. With this ongoing series, you’ll get timely insights after each meeting, helping you make informed decisions about your home financing needs. The Federal Reserve’s latest announcement has given us a […]

Market Update: FOMC Meeting Summary for June 12

As part of our commitment to keep you informed, we’re providing a snapshot of the latest FOMC meeting and its implications for the mortgage market. With this ongoing series, you’ll get timely insights after each meeting, helping you make informed decisions about your home financing needs. Let’s talk about the latest news in money […]

Market Update: July 2024 Weak Jobs Report

Seize the Moment: The Last Jobs Report May Benefit Homebuyers and Homeowners In recent news, the July jobs report revealed a weaker-than-expected increase in payrolls, with the U.S. adding only 114,000 jobs compared to the anticipated 175,000. Additionally, the unemployment rate rose from 4.1% to 4.3%. This news has caught the attention of Federal Reserve […]

Market Update: Rates Rebound Through November

Market Update: Will Rates Keep Moving Up? As we move into November, let’s take a look at how the housing market has moved since our last update in August. For those of you waiting on the sidelines to purchase a home, here’s a recap of key trends and insights to help you decide your next […]

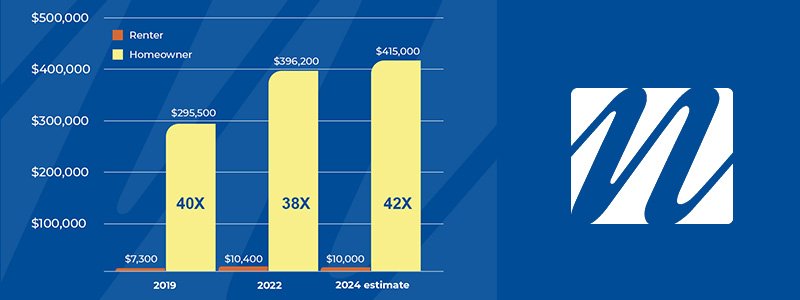

Why Homeownership Remains the Best Hedge Against Inflation

As inflation rises and the cost of living continues to increase, many people are feeling the squeeze in their budgets. While it might seem tempting to rent and wait for the market to calm down, there’s a compelling reason why now could be the perfect time to buy a home: building wealth through homeownership. A […]