Market Update: FOMC Meeting Summary for June 12

As part of our commitment to keep you informed, we’re providing a snapshot of the latest FOMC meeting and its implications for the mortgage market. With this ongoing series, you’ll get timely insights after each meeting, helping you make informed decisions about your home financing needs. Let’s talk about the latest news in money […]

Market Update: July 2024 Weak Jobs Report

Seize the Moment: The Last Jobs Report May Benefit Homebuyers and Homeowners In recent news, the July jobs report revealed a weaker-than-expected increase in payrolls, with the U.S. adding only 114,000 jobs compared to the anticipated 175,000. Additionally, the unemployment rate rose from 4.1% to 4.3%. This news has caught the attention of Federal Reserve […]

Market Update: Rates Rebound Through November

Market Update: Will Rates Keep Moving Up? As we move into November, let’s take a look at how the housing market has moved since our last update in August. For those of you waiting on the sidelines to purchase a home, here’s a recap of key trends and insights to help you decide your next […]

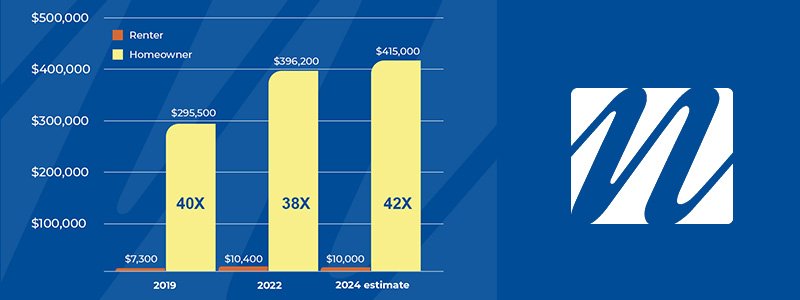

Why Homeownership Remains the Best Hedge Against Inflation

As inflation rises and the cost of living continues to increase, many people are feeling the squeeze in their budgets. While it might seem tempting to rent and wait for the market to calm down, there’s a compelling reason why now could be the perfect time to buy a home: building wealth through homeownership. A […]

Market Update: Strong Jobs Report for May 2025

The U.S. economy added 177,000 jobs in April, surpassing expectations and maintaining the unemployment rate at 4.2%. Significant gains were observed in healthcare (+51,000 jobs) and transportation and warehousing (+29,000 jobs), while federal employment declined by 9,000 positions. This robust labor market suggests that the Federal Reserve is likely to maintain its current interest rate […]

Jobs Report Lands: What It Means for Mortgage Rates

This morning’s U.S. jobs report arrived at 8:30 a.m. ET, and the results are already making headlines. The labor market is showing signs of slowing down, adding just 22,000 jobs in August compared to expectations of around 75,000. The unemployment rate ticked up to 4.3%, the highest since before the pandemic. So, why does this […]

Fed Cuts Rates by 0.25%: What It Means for Mortgages

Yesterday, the Federal Reserve cut its benchmark rate by 0.25%—the first rate cut since December. While that move was widely anticipated, what’s been more interesting is how mortgage rates and homeowner behavior have reacted. Now that we’ve had a little time to see the market settle, here’s what we know—and what it could mean for […]

The Mortgage Process in Georgia: What Roswell Buyers Should Expect-[Copy #2803]

Buying a home is one of the biggest milestones in life – and understanding the mortgage process can make all the difference. If you’re searching for mortgage lenders in Roswell, GA, or wondering what to expect when applying for a home loan, this guide will walk you through each step. At Northpoint Mortgage in Roswell, our team […]